Franchise Expo South

Franchising has its own special challenges when it comes to arriving at “one version of the truth” with financial and operational reporting. The structure of franchising is rife with opportunities to silo information of all kinds, missing opportunities to improve performance. Having a common and consistent reporting system at the corporate level and across all units and functions can help everyone run their business better (more profitably!!!!) and enjoy the rewards of being a truly successful owner/operator.

Where to start:

- Articulate a clear, practical vision.

Include and enroll all the business function leaders/owner-operators in the vision and the benefit of Financial, Planning & Analysis (FP&A, aka Operational Finance). Make sure each department/business unit/owner-operator understands what and how much they stand to gain with FP&A transformation in terms of increased efficiency and profitability! Visibility begets clarity. Clarity is crucial for real-time decision-making. - Identify goals and align KPIs

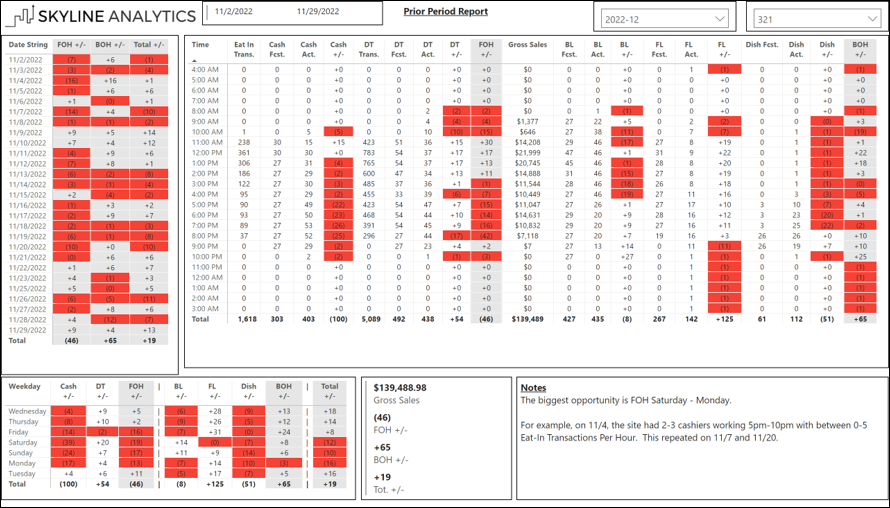

What is it you’re trying to accomplish as a whole (more efficient labor, better COGS, customer-level analytics and topline revenue growth)? What are management’s goals (more efficient and streamlined reporting, accurate annual budgeting and forecasting)? Alignment is critical to success. Goals must be identified and KPIs aligned to measure progress toward those goals. Understand the top-line goals and then break those apart to understand how those goals translate to each business unit and/or function. Once you have your goals, identify the right KPIs to use – and keep it simple. More isn’t better – it’s just more. - Create your TOM.

Once you understand your goals and how each business unit/franchise will contribute to success, you want to articulate your target operating model – your TOM. What works best for your specific business will be unique. Every organization is different – even organizations in the same industry – so your TOM will reflect that. A TOM is critical to success. Having a structure for how your business should operate optimally will help ensure it provides value for customers as well as your stakeholders. - Identify all data sources* that affect your business – such as

- Point-of-Sale

- Accounting

- Customer Relationship Management

- HR/Staffing

- Inventory

- Maintenance

*If your business needs it to run, it needs to be included in the data pools.

- Decide process for planning reporting and analytics/analysis

There must be a consistent process in how your data is collected, organized, analyzed and interpreted. Providing a “single source of truth” for franchisors and franchisees gives clarity on how and where improvements can be made to improve financial as well as operational performance. Solid performance produces happy franchisees; happy franchisees buy more units.

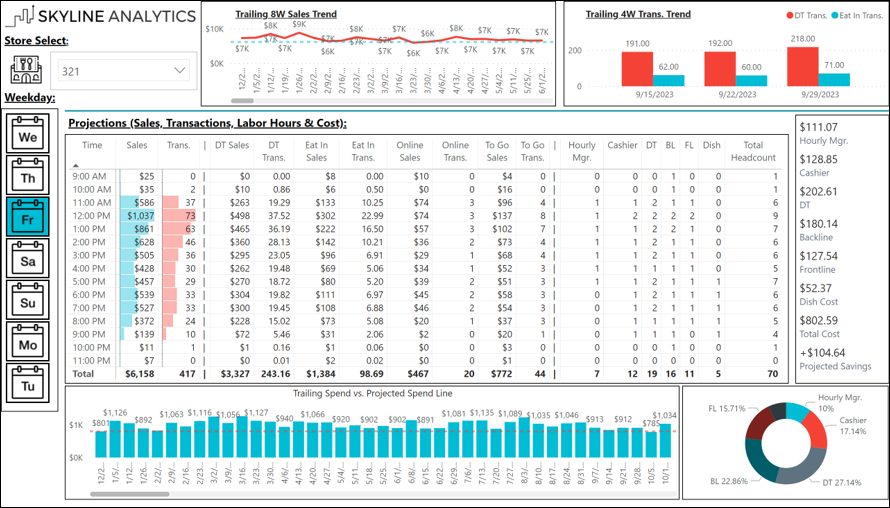

Skyline Analytics helps franchise businesses (both franchisors and franchisees) every day solve for these sorts of challenges. We are not “plug ‘n’ play” as our solution are a combination of technology, tools, and MOST importantly talent – all designed to meet your particular needs and goals. We deploy/use AI (of course) but we also leverage HI – human intelligence, which is imperative to understanding the nuances unique to every business.

Good FP&A = strategic finance = greater profitability!! It is the bedrock of any organization’s success and having it is a competitive advantage. The right approach to FP&A will offer immediate return on investment (ROI). Skyline Analytics can deliver insights for adaptive, real-time decisions as well as meaningful bottom-line contribution.

Think you could benefit from best-in-class FP&A? Let’s talk.

Skyline Analytics